Products

By Team

Sales

Multithread effectively and personalize outreach to convert deals faster

Social Media Marketing

Elevate social presence and drive business growth from social media

RevOps

Identify and prioritize high-intent leads, and improve sales effectiveness

Events & Field Marketing

Find and connect with ICP attendees, and improve event outcomes

Resources

ZipLoan

What Does ZipLoan Do?

ZipLoan is an RBI registered Non-Banking Financial Company (NBFC) revolutionizing MSME lending in India. Founded in 2015, the company leverages technology to provide fast, flexible, and unsecured business loans to small and medium-sized enterprises. ZipLoan aims to make credit more accessible to MSMEs, helping them manage working capital, purchase inventory, acquire new machinery, or expand their operations. Their digital-first approach simplifies the loan application and disbursal process, making finance more convenient for underserved businesses.

Where Is ZipLoan's Headquarters?

HQ Function

The headquarters serves as the central hub for strategic decision-making, technology development, credit underwriting policies, product innovation, customer support management, and overall business operations for ZipLoan's MSME lending services.

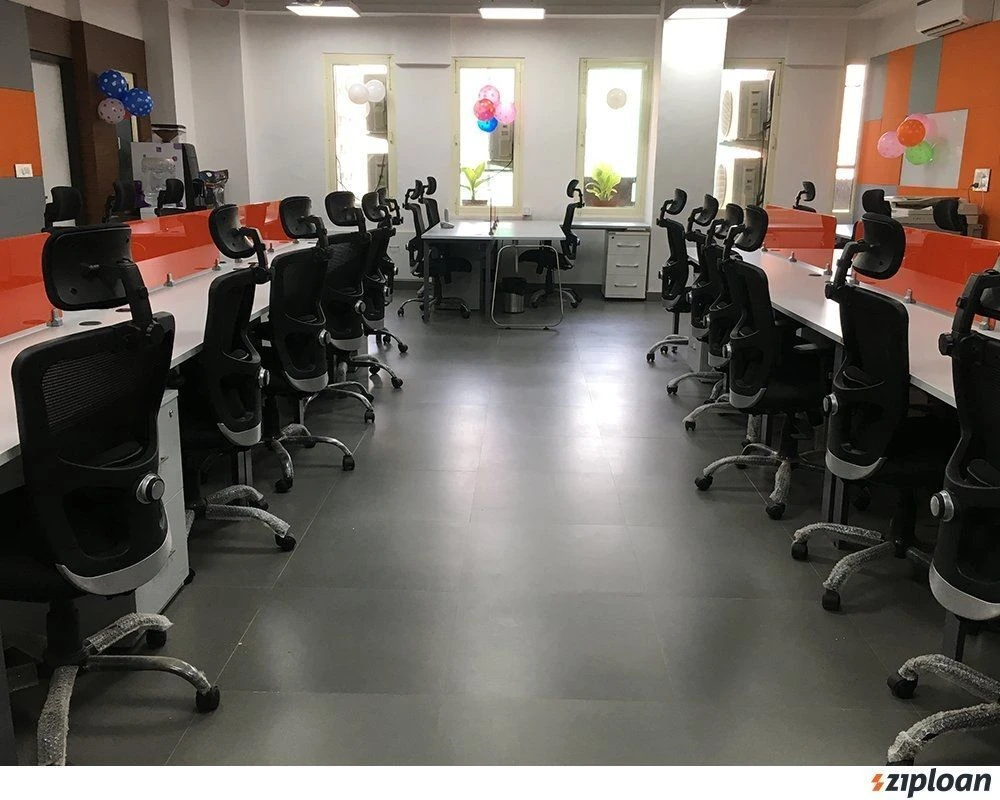

Notable Features:

A modern office environment designed to foster collaboration and innovation, equipped with technology infrastructure to support a fast-paced fintech operation. It likely includes open-plan workspaces, meeting areas, and facilities conducive to an agile work style.

Work Culture:

ZipLoan fosters a dynamic, customer-centric, and results-oriented work culture. There's a strong emphasis on leveraging technology for efficiency, fostering teamwork, and empowering employees to contribute to the mission of financial inclusion for MSMEs. The environment is typically fast-paced, reflecting the nature of the fintech industry.

HQ Significance:

As the nerve center of ZipLoan, the headquarters is crucial for driving its mission to provide accessible and timely credit to small businesses across India. It's where key strategies are formulated and technological advancements are driven to enhance their service delivery and expand their reach in the MSME sector.

Values Reflected in HQ: The headquarters likely reflects ZipLoan's core values such as speed, transparency, customer-centricity, and innovation through an efficient office layout, integration of modern technology, and spaces that encourage open communication and collaboration.

Location:

ZipLoan's primary operational focus is within India, where it leverages its digital platform and branch network to serve Micro, Small, and Medium Enterprises (MSMEs) across various cities. While currently India-centric, its technology-driven lending model and expertise in underwriting for small businesses have the potential for applicability in other emerging markets facing similar MSME credit gaps. As of now, there are no public announcements of international expansion.

Street Address:

A-5, Shankar Garden, Opposite Metro Pillar No. 621, Vikaspuri

City:

New Delhi

State/Province:

Delhi

Country:

India

Where Else Does ZipLoan Operate Around the World?

Mumbai, Maharashtra/India

Address: 5th Floor, Office No 501-503, Paradigm, A Wing, Mindspace, Malad West, Mumbai, Maharashtra 400064

To effectively cater to the high demand for MSME financing in Mumbai, one of India's largest commercial and financial centers. The office provides localized services and support, ensuring better accessibility for small businesses seeking ZipLoan's lending solutions in the region.

Jaipur, Rajasthan/India

Address: Information on specific street address for Jaipur office is not readily available, but ZipLoan confirms operations in Jaipur.

To support the growth of small and medium-sized businesses in Jaipur by providing accessible and timely business loans, contributing to the economic development of the region.

Lucknow, Uttar Pradesh/India

Address: Information on specific street address for Lucknow office is not readily available, but ZipLoan confirms operations in Lucknow.

To expand financial inclusion for MSMEs in Lucknow and surrounding areas, offering them collateral-free business loans to foster their growth and sustainability.

Buying Intent Signals for ZipLoan

Highperformr Signals uncover buying intent and give you clear insights to target the right accounts at the right time — helping your sales, marketing, and GTM teams close more deals, faster.

Who's Leading ZipLoan? Meet the Executive Team

As of April 2025, ZipLoan' leadership includes:

Who's Investing in ZipLoan?

ZipLoan has been backed by several prominent investors over the years, including:

What Leadership Changes Has ZipLoan Seen Recently?

As a privately held company, ZipLoan does not frequently publicize all executive movements. The core leadership, including co-founders Kshitij Puri (CEO) and Shalabh Singhal (COO), remains stable and actively involved in operations. No major C-level hires or departures have been prominently reported in mainstream financial news or official company channels in the last 12 months. Focus appears to be on consistent leadership driving growth.

What Technology (Tech Stack) Is Used byZipLoan?

Discover the tools ZipLoan uses. Highperformr reveals the technologies powering your target accounts — helping your sales, marketing, and GTM teams prioritize smarter and close faster.

ZipLoan Email Formats and Examples

ZipLoan likely utilizes standard corporate email formats for its professional communications. Common patterns for tech and financial service companies in India often include variations of first name, last name, and initials followed by the company domain.

[first_initial][last]@ziploan.in (e.g., kpuri@ziploan.in) or [first].[last]@ziploan.in (e.g., kshitij.puri@ziploan.in). Another possibility is [first]@ziploan.in.

Format

kpuri@ziploan.in

Example

85%

Success rate

What's the Latest News About ZipLoan?

ET BFSI • March 20, 2024

ZipLoan news: SIDBI partners with fintech NBFC ZipLoan to extend credit accessibility for MSMEs

The Small Industries Development Bank of India (SIDBI) has partnered with ZipLoan, a fintech NBFC, to enhance credit accessibility for Micro, Small, and Medium Enterprises (MSMEs). This collaboration aims to leverage ZipLoan's digital lending platform to reach more small businesses in need of financial assistance....more

ET BFSI • February 14, 2024

ZipLoan news: ZipLoan partners with AU Small Finance Bank to disburse loans worth Rs 100 crore to MSMEs

ZipLoan has entered into a co-lending partnership with AU Small Finance Bank with the goal of disbursing loans amounting to Rs 100 crore to MSMEs. This collaboration combines ZipLoan's sourcing and servicing expertise with AU Small Finance Bank's funding capabilities to support small business growth....more

The Economic Times • September 20, 2022

ZipLoan news: MSME lender ZipLoan gets debt funding of Rs 20 crore from Stride Ventures

ZipLoan secured Rs 20 crore in debt funding from Stride Ventures. This funding was intended to help ZipLoan expand its loan book and reach more MSMEs across India, strengthening its position in the digital lending space....more

Highperformr's free tools for company research

Explore Employees by Region or Country

See where a company’s workforce is located, by country or region.

View Funding Details

View past and recent funding rounds with amounts and investors.

Understand Revenue Insights

Understand company revenue estimates and financial scale.

Track Active Job Openings

Track active roles and hiring trends to spot growth signals.

Review Product and Offerings

Discover what a company offers—products, platforms, and solutions.

Get SIC or NAICS Codes

Get the company’s official SIC and NAICS classifications.

Analyze Website Traffic Trends

Analyze visitor volume, engagement, and top traffic sources.

Discover Social Profiles and Engagement

Explore LinkedIn, Twitter, and other active social profiles.

Identify Top Competitors

Identify top competitors based on similar business traits.

Research and Discover Companies with Highperformr — Smarter, Faster

Explore companies in depth — from the tech they use to recent funding, hiring trends, and buyer signals — all in one powerful view.

Highperformr AI helps you surface the right accounts and enrich your CRM with verified company and contact insights, so your teams can prioritize and engage faster.

- Track intent signals to find buyers who are actively in-market

- Enrich contacts and companies instantly, no need to switch tools

- Automate workflows to stay ahead of every change

- Connect your CRM & tools for seamless data sync and activation

Thousands of companies, including ZipLoan, are just a search away.

.png)

.png)