Products

By Team

Sales

Multithread effectively and personalize outreach to convert deals faster

Social Media Marketing

Elevate social presence and drive business growth from social media

RevOps

Identify and prioritize high-intent leads, and improve sales effectiveness

Events & Field Marketing

Find and connect with ICP attendees, and improve event outcomes

Resources

European Banking Authority (EBA)

What Does European Banking Authority (EBA) Do?

The European Banking Authority (EBA) is an independent EU authority established on 1 January 2011. Its primary objective is to contribute to the stability and effectiveness of the European financial system. The EBA works to ensure a stable, efficient, and well-regulated banking sector across the European Union by developing and maintaining a single rulebook for all EU financial institutions, promoting supervisory convergence, and assessing risks and vulnerabilities in the EU banking sector. It plays a crucial role in fostering consumer protection and transparency in financial products and services.

Where Is European Banking Authority (EBA)'s Headquarters?

HQ Function

The headquarters serves as the central hub for all EBA operations, including policy development, supervisory oversight coordination, risk assessment, and engagement with EU institutions and national competent authorities.

Notable Features:

Located in the modern Europlaza tower in La Défense, Paris's major business district. The office provides a contemporary and well-equipped workspace for its international staff.

Work Culture:

A highly professional, multicultural, and collaborative environment focused on financial stability and regulatory excellence. Emphasis on expertise, integrity, analytical rigor, and a public service ethos dedicated to the EU's financial well-being.

HQ Significance:

The Paris headquarters symbolizes the EBA's continued central role in the EU's financial architecture post-Brexit, positioning it strategically within a key Eurozone financial center.

Values Reflected in HQ: The headquarters' location in a prominent business district and its modern facilities reflect the EBA's commitment to professionalism, efficiency, and its significant role in the European financial landscape.

Location:

As an EU agency, the EBA's direct operational presence is its headquarters in Paris. However, its regulatory influence and supervisory coordination extend across all European Union member states. It works closely with National Competent Authorities (NCAs) in each EU country, forming part of the European System of Financial Supervision (ESFS). The EBA also engages with international bodies and non-EU regulators on matters of global financial stability and regulatory standards.

Street Address:

Tour Europlaza, 20 Avenue André Prothin, La Défense 4

City:

Courbevoie (Paris La Défense)

State/Province:

Île-de-France

Country:

France

Where Else Does European Banking Authority (EBA) Operate Around the World?

No additional office locations available.

Buying Intent Signals for European Banking Authority (EBA)

Highperformr Signals uncover buying intent and give you clear insights to target the right accounts at the right time — helping your sales, marketing, and GTM teams close more deals, faster.

Who's Leading European Banking Authority (EBA)? Meet the Executive Team

As of April 2025, European Banking Authority (EBA)' leadership includes:

Who's Investing in European Banking Authority (EBA)?

European Banking Authority (EBA) has been backed by several prominent investors over the years, including:

What Leadership Changes Has European Banking Authority (EBA) Seen Recently?

The EBA maintains a stable senior management team. Significant changes at the highest executive levels (Chairperson, Executive Director) are infrequent and subject to formal EU appointment processes. Any recent director-level changes or board appointments are typically announced on their official website.

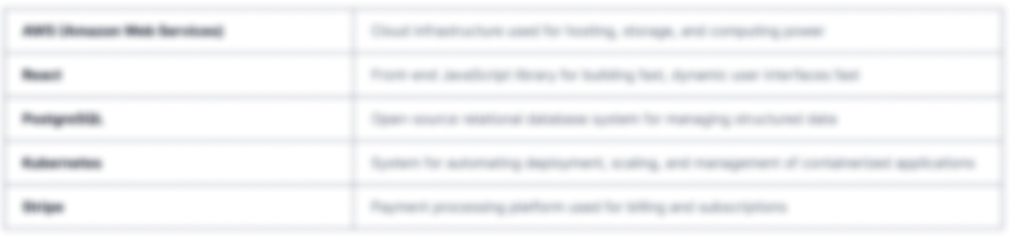

What Technology (Tech Stack) Is Used byEuropean Banking Authority (EBA)?

Discover the tools European Banking Authority (EBA) uses. Highperformr reveals the technologies powering your target accounts — helping your sales, marketing, and GTM teams prioritize smarter and close faster.

European Banking Authority (EBA) Email Formats and Examples

The European Banking Authority, like many EU institutions, typically uses a standard email format combining an employee's first name and last name with the domain eba.europa.eu.

firstname.lastname@eba.europa.eu

Format

john.doe@eba.europa.eu

Example

90%

Success rate

What's the Latest News About European Banking Authority (EBA)?

EBA Website • June 4, 2024

EBA publishes its final draft technical standards under MiCA to safeguard orderly market conditions

The European Banking Authority (EBA) today published three sets of final draft regulatory technical standards (RTS) and one set of final draft implementing technical standards (ITS) relating to the prudential treatment of crypto-assets, and the requirements for issuers of asset-referenced tokens (ARTs) and electronic money tokens (EMTs) under the Markets in Crypto-Assets Regulation (MiCAR)....more

EBA Website • May 28, 2024

EBA finds EU banks are generally prepared for Basel III implementation but some areas require further attention

The European Banking Authority (EBA) published today its final Basel III monitoring report, which assesses the impact of the final set of Basel III reforms on EU banks. The report shows that EU banks are generally well-prepared for the implementation of these standards, with most institutions already meeting or being close to meeting the new capital requirements....more

EBA Website • April 30, 2024

EBA observes significant increase in deposits covered by DGSs and in available financial means of deposit guarantee schemes

The European Banking Authority (EBA) published today data for the EU- M29wide deposit guarantee schemes (DGSs). The data shows a significant increase of 7.6% in covered deposits in the EU, reaching EUR 8,115bn at the end of 2023. The available financial means of DGSs also increased by 15.1% and amounted to EUR 65bn....more

Highperformr's free tools for company research

Explore Employees by Region or Country

See where a company’s workforce is located, by country or region.

View Funding Details

View past and recent funding rounds with amounts and investors.

Understand Revenue Insights

Understand company revenue estimates and financial scale.

Track Active Job Openings

Track active roles and hiring trends to spot growth signals.

Review Product and Offerings

Discover what a company offers—products, platforms, and solutions.

Get SIC or NAICS Codes

Get the company’s official SIC and NAICS classifications.

Analyze Website Traffic Trends

Analyze visitor volume, engagement, and top traffic sources.

Discover Social Profiles and Engagement

Explore LinkedIn, Twitter, and other active social profiles.

Identify Top Competitors

Identify top competitors based on similar business traits.

Research and Discover Companies with Highperformr — Smarter, Faster

Explore companies in depth — from the tech they use to recent funding, hiring trends, and buyer signals — all in one powerful view.

Highperformr AI helps you surface the right accounts and enrich your CRM with verified company and contact insights, so your teams can prioritize and engage faster.

- Track intent signals to find buyers who are actively in-market

- Enrich contacts and companies instantly, no need to switch tools

- Automate workflows to stay ahead of every change

- Connect your CRM & tools for seamless data sync and activation

Thousands of companies, including European Banking Authority (EBA), are just a search away.

.png)

.png)