Products

By Team

Sales

Multithread effectively and personalize outreach to convert deals faster

Social Media Marketing

Elevate social presence and drive business growth from social media

RevOps

Identify and prioritize high-intent leads, and improve sales effectiveness

Events & Field Marketing

Find and connect with ICP attendees, and improve event outcomes

Resources

Bank of Uganda

What Does Bank of Uganda Do?

The Bank of Uganda (BoU) is the central bank of the Republic of Uganda, established on August 15, 1966. Its primary mandate is to foster price stability and a sound financial system. Key responsibilities include formulating and implementing monetary policy, issuing and managing the Ugandan Shilling, regulating financial institutions, managing foreign exchange reserves, and acting as a banker and financial advisor to the government. BoU is instrumental in Uganda's economic progress by promoting financial inclusion and macroeconomic stability.

Where Is Bank of Uganda's Headquarters?

HQ Function

The headquarters serves as the primary operational and administrative center for all central banking functions, including monetary policy formulation and implementation, financial market operations, banking supervision, currency issuance and management, and strategic economic decision-making.

Notable Features:

The Bank of Uganda building is a prominent architectural landmark in Kampala's central business district. It features a modern design, housing specialized facilities such as secure currency vaults, advanced data centers, and conference facilities for national and international financial deliberations.

Work Culture:

The work culture at the Bank of Uganda is characterized by professionalism, meticulousness, and a strong sense of public service. It emphasizes integrity, accuracy, economic research, policy analysis, and adherence to stringent regulatory and ethical standards, typical of a leading national financial institution.

HQ Significance:

As the headquarters of the nation's central bank, this location is of paramount significance. Decisions made here directly influence Uganda's inflation rates, interest rates, exchange rates, financial stability, and overall economic trajectory. It is a symbol of Uganda's monetary sovereignty and economic stewardship.

Values Reflected in HQ: The headquarters' design, security, and operational protocols aim to reflect core values such as financial stability, integrity, transparency, accountability, professionalism, and national economic resilience.

Location:

Bank of Uganda's global presence is primarily through its active engagement with international financial institutions such as the International Monetary Fund (IMF), World Bank, African Development Bank (AfDB), and partnerships with other central banks globally. It participates in international monetary and financial forums, maintains correspondent banking relationships, manages the country's foreign currency reserves via international markets, and collaborates on cross-border financial stability, regulatory harmonization, and economic policy initiatives. The Bank does not operate commercial branches outside Uganda.

Street Address:

37/45 Kampala Road

City:

Kampala

State/Province:

Central Region

Country:

Uganda

Where Else Does Bank of Uganda Operate Around the World?

Jinja, Eastern Region, Uganda

Address: Plot 20-22, Main Street, Jinja

To decentralize currency operations, ensure efficient and secure cash supply, and extend central banking services to financial institutions and the public across Uganda's Eastern region.

Mbarara, Western Region, Uganda

Address: Plot 20-22, High Street, Mbarara

To manage currency circulation effectively, ensure sufficient liquidity for economic activities, and provide accessible central bank support services in the Western region of Uganda.

Gulu, Northern Region, Uganda

Address: Plot 20-22, Acholi Road, Gulu

To meet the currency demands of Northern Uganda, promote financial system integrity, support financial institutions, and contribute to sustainable economic growth in the area.

Buying Intent Signals for Bank of Uganda

Highperformr Signals uncover buying intent and give you clear insights to target the right accounts at the right time — helping your sales, marketing, and GTM teams close more deals, faster.

Who's Leading Bank of Uganda? Meet the Executive Team

As of April 2025, Bank of Uganda' leadership includes:

Who's Investing in Bank of Uganda?

Bank of Uganda has been backed by several prominent investors over the years, including:

What Leadership Changes Has Bank of Uganda Seen Recently?

The Bank of Uganda's top executive leadership has maintained stability over the past year, with Deputy Governor Dr. Michael Atingi-Ego continuing to perform the duties of the Governor since early 2022. While no major changes in the day-to-day executive management team (Executive Directors) were prominently reported, the Bank saw appointments to its Board of Directors, such as Dr. Ibrahim L. Stevens in early 2024, enhancing governance and oversight.

New Appointments:

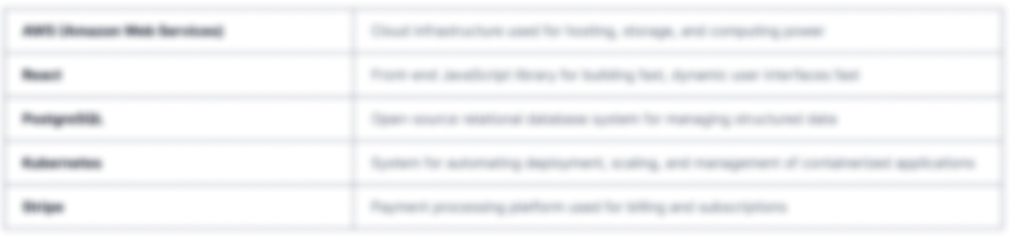

What Technology (Tech Stack) Is Used byBank of Uganda?

Discover the tools Bank of Uganda uses. Highperformr reveals the technologies powering your target accounts — helping your sales, marketing, and GTM teams prioritize smarter and close faster.

Bank of Uganda Email Formats and Examples

Bank of Uganda generally utilizes a standardized email format for its staff, typically combining the first initial and last name of the employee followed by the official domain '@bou.or.ug'. This format is common for official communications.

[FirstInitial][LastName]@bou.or.ug

Format

amugume@bou.or.ug

Example

80%

Success rate

What's the Latest News About Bank of Uganda?

Daily Monitor • May 27, 2024

Bank of Uganda Faces Renewed Parliamentary Probe Over Crane Bank Closure

Uganda's Parliament has initiated a fresh investigation into the Bank of Uganda's handling of the 2016 closure of Crane Bank Limited. The parliamentary committee on Commissions, Statutory Authorities and State Enterprises (COSASE) will re-examine the procedures and circumstances surrounding the central bank's takeover and subsequent sale of the defunct commercial bank....more

New Vision • May 14, 2024

Bank of Uganda Maintains Central Bank Rate (CBR) at 10.25%

The Bank of Uganda's Monetary Policy Committee announced its decision to keep the Central Bank Rate (CBR) unchanged at 10.25 percent in May 2024. This decision reflects the Bank's assessment of the current inflation outlook and overall economic conditions, aiming to ensure inflation remains within its medium-term target....more

The Independent Uganda • March 7, 2024

Bank of Uganda Announces Plans for New Banknotes with Enhanced Security Features

The Bank of Uganda revealed its intention to issue a new series of Ugandan banknotes. These new notes will incorporate upgraded security features to combat counterfeiting and will also feature a new signature, as the current notes bear the signature of the late Governor Emmanuel Tumusiime-Mutebile....more

Highperformr's free tools for company research

Explore Employees by Region or Country

See where a company’s workforce is located, by country or region.

View Funding Details

View past and recent funding rounds with amounts and investors.

Understand Revenue Insights

Understand company revenue estimates and financial scale.

Track Active Job Openings

Track active roles and hiring trends to spot growth signals.

Review Product and Offerings

Discover what a company offers—products, platforms, and solutions.

Get SIC or NAICS Codes

Get the company’s official SIC and NAICS classifications.

Analyze Website Traffic Trends

Analyze visitor volume, engagement, and top traffic sources.

Discover Social Profiles and Engagement

Explore LinkedIn, Twitter, and other active social profiles.

Identify Top Competitors

Identify top competitors based on similar business traits.

Research and Discover Companies with Highperformr — Smarter, Faster

Explore companies in depth — from the tech they use to recent funding, hiring trends, and buyer signals — all in one powerful view.

Highperformr AI helps you surface the right accounts and enrich your CRM with verified company and contact insights, so your teams can prioritize and engage faster.

- Track intent signals to find buyers who are actively in-market

- Enrich contacts and companies instantly, no need to switch tools

- Automate workflows to stay ahead of every change

- Connect your CRM & tools for seamless data sync and activation

Thousands of companies, including Bank of Uganda, are just a search away.

.png)

.png)