Products

By Team

Sales

Multithread effectively and personalize outreach to convert deals faster

Social Media Marketing

Elevate social presence and drive business growth from social media

RevOps

Identify and prioritize high-intent leads, and improve sales effectiveness

Events & Field Marketing

Find and connect with ICP attendees, and improve event outcomes

Resources

Archstone

What Does Archstone Do?

Archstone was a prominent U.S. real estate investment trust (REIT) that specialized in the ownership, development, acquisition, and operation of high-quality apartment communities. Focused on major metropolitan areas across the United States, particularly in coastal and high-barrier-to-entry markets, Archstone was known for its upscale properties and significant portfolio. In 2013, the company was acquired by Equity Residential and AvalonBay Communities, marking the end of its operations as an independent entity. Its legacy portfolio continues to be part of these successor companies.

Where Is Archstone's Headquarters?

HQ Function

The headquarters served as the central command for all national operations, including strategic planning, investment decisions, property management oversight, development projects, finance, legal, and corporate administration for its extensive apartment portfolio.

Notable Features:

The headquarters was likely a modern corporate office facility, designed to accommodate a large executive and administrative staff. Specific architectural details are not widely emphasized post-acquisition, but it would have been a Class A office space befitting a major national corporation.

Work Culture:

Archstone fostered a professional, performance-driven work culture typical of a large real estate investment firm. Emphasis was placed on market expertise, operational efficiency, asset management, and delivering value to shareholders and residents. The environment would have been dynamic, focused on growth and quality in the multifamily housing sector.

HQ Significance:

The Englewood headquarters was the nerve center for one of the largest apartment owners and operators in the U.S., directing a multi-billion dollar portfolio and influencing housing markets in numerous key American cities. Decisions made here impacted thousands of employees and residents.

Values Reflected in HQ: The headquarters would have reflected values of professionalism, market leadership, stability, and a commitment to high-quality real estate assets and operations.

Location:

Archstone's primary operational focus was within the United States, where it owned and managed a vast portfolio of apartment communities. Its presence was concentrated in major coastal markets including Southern California, the San Francisco Bay Area, Seattle, Washington D.C. metro, South Florida, Boston, and New York City, as well as other high-growth urban centers. Functions supported across these regions included property operations, asset management, acquisitions, development, and regional marketing. While predominantly U.S.-based, Archstone did have a period of investment activity in Germany, though its core identity and largest operations remained domestic.

Street Address:

9200 E. Panorama Circle, Suite 400

City:

Englewood

State/Province:

Colorado

Country:

USA

Where Else Does Archstone Operate Around the World?

Washington, D.C., USA

Address: Various locations in the D.C. Metro Area (e.g., Class A office buildings in Arlington, VA or Washington D.C.)

To oversee and expand Archstone's presence in the densely populated and economically robust Washington D.C. metropolitan area, focusing on high-end apartment living.

Irvine, California, USA

Address: Key office parks in Orange County (e.g., near John Wayne Airport)

To capitalize on strong demand for luxury rental housing in Southern California's major urban and suburban centers, managing a substantial portfolio in cities like Los Angeles, San Diego, and Orange County.

New York City, New York, USA

Address: Midtown Manhattan or other prime commercial locations

To manage and grow Archstone's portfolio in the high-barrier-to-entry New York market, navigating its unique regulatory and competitive landscape.

Buying Intent Signals for Archstone

Highperformr Signals uncover buying intent and give you clear insights to target the right accounts at the right time — helping your sales, marketing, and GTM teams close more deals, faster.

Who's Leading Archstone? Meet the Executive Team

As of April 2025, Archstone' leadership includes:

Who's Investing in Archstone?

Archstone has been backed by several prominent investors over the years, including:

What Leadership Changes Has Archstone Seen Recently?

Archstone was acquired in February 2013 and ceased to operate as an independent company. Consequently, there have been no executive hires or exits attributable to Archstone in the last 12 months, or since its acquisition. Any news regarding former Archstone executives would pertain to their roles at other organizations.

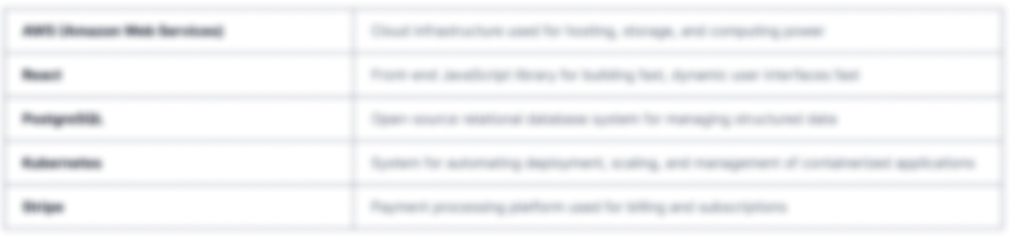

What Technology (Tech Stack) Is Used byArchstone?

Discover the tools Archstone uses. Highperformr reveals the technologies powering your target accounts — helping your sales, marketing, and GTM teams prioritize smarter and close faster.

Archstone Email Formats and Examples

Prior to its 2013 acquisition, Archstone likely utilized standard corporate email address formats. Common structures included combining the first initial with the last name, or first name separated from the last name by a dot, followed by the company domain.

Likely formats: [first_initial][last]@archstone.com or [first].[last]@archstone.com. The primary domain was archstone.com or archstoneapartments.com.

Format

jdoe@archstone.com

Example

0 (Company email domains are no longer active for general business communication post-acquisition).%

Success rate

What's the Latest News About Archstone?

Reuters / Equity Residential / AvalonBay Communities • November 26, 2012 (Announcement) / February 27, 2013 (Closing)

Archstone Acquired by Equity Residential and AvalonBay for $16 Billion

Equity Residential and AvalonBay Communities announced and subsequently completed the acquisition of Archstone Enterprise LP for a total consideration of approximately $16 billion, including the assumption of debt. This landmark transaction divided Archstone's extensive portfolio of U.S. apartment communities between the two acquiring REITs, significantly expanding their respective holdings in key high-growth markets....more

The New York Times / Company Press Releases • October 5, 2007

Archstone-Smith Goes Private in $22.2 Billion Deal Led by Tishman Speyer and Lehman Brothers

Archstone-Smith Trust, then a publicly traded REIT, was taken private in a leveraged buyout valued at $22.2 billion (including debt) by a partnership of Tishman Speyer Properties and Lehman Brothers. This transaction was one of the largest REIT privatizations at the time and transitioned Archstone into a privately held entity known as Archstone Enterprise LP....more

Highperformr's free tools for company research

Explore Employees by Region or Country

See where a company’s workforce is located, by country or region.

View Funding Details

View past and recent funding rounds with amounts and investors.

Understand Revenue Insights

Understand company revenue estimates and financial scale.

Track Active Job Openings

Track active roles and hiring trends to spot growth signals.

Review Product and Offerings

Discover what a company offers—products, platforms, and solutions.

Get SIC or NAICS Codes

Get the company’s official SIC and NAICS classifications.

Analyze Website Traffic Trends

Analyze visitor volume, engagement, and top traffic sources.

Discover Social Profiles and Engagement

Explore LinkedIn, Twitter, and other active social profiles.

Identify Top Competitors

Identify top competitors based on similar business traits.

Research and Discover Companies with Highperformr — Smarter, Faster

Explore companies in depth — from the tech they use to recent funding, hiring trends, and buyer signals — all in one powerful view.

Highperformr AI helps you surface the right accounts and enrich your CRM with verified company and contact insights, so your teams can prioritize and engage faster.

- Track intent signals to find buyers who are actively in-market

- Enrich contacts and companies instantly, no need to switch tools

- Automate workflows to stay ahead of every change

- Connect your CRM & tools for seamless data sync and activation

Thousands of companies, including Archstone, are just a search away.

.png)

.png)