Products

By Team

Sales

Multithread effectively and personalize outreach to convert deals faster

Social Media Marketing

Elevate social presence and drive business growth from social media

RevOps

Identify and prioritize high-intent leads, and improve sales effectiveness

Events & Field Marketing

Find and connect with ICP attendees, and improve event outcomes

Resources

17 Asset Management

What Does 17 Asset Management Do?

17 Asset Management (17 AM) is a global asset management firm dedicated to impact investing, specifically targeting the United Nations Sustainable Development Goals (SDGs). The firm designs, implements, and manages investment strategies and financial products that aim to generate both competitive financial returns and positive, measurable social and environmental impacts. They work with a diverse range of clients including institutional investors, family offices, and foundations, focusing on mobilizing private capital towards projects and companies that contribute to sustainable development, particularly in emerging and frontier markets. 17 AM often employs innovative financial structures, such as blended finance, to de-risk investments and attract capital to underserved areas and sectors critical for achieving the SDGs.

Where Is 17 Asset Management's Headquarters?

HQ Function

The New York headquarters serves as the primary center for strategic decision-making, investment management, research, product development, and global operational oversight.

Notable Features:

Situated in a prominent Manhattan location, providing excellent access to financial markets, institutional investors, and international development organizations.

Work Culture:

The work culture is likely mission-driven, collaborative, and intellectually stimulating, attracting professionals passionate about sustainable finance and achieving tangible global impact. Emphasis would be on innovation and rigorous analysis.

HQ Significance:

Being headquartered in New York City positions 17 Asset Management at the crossroads of global finance and sustainable development thought leadership, facilitating partnerships and capital mobilization.

Values Reflected in HQ: The choice of a prestigious New York address reflects professionalism, global ambition, and a commitment to engaging mainstream financial players in the pursuit of sustainable development goals.

Location:

With key offices in New York and Paris, 17 Asset Management supports its global impact mission. These hubs facilitate worldwide deal origination, investment structuring, due diligence, portfolio management, and engagement with international partners and investors. Their global functions also include developing blended finance solutions, conducting impact measurement and management (IMM), and fostering relationships with development organizations to drive capital towards achieving the UN SDGs across diverse geographies, particularly in emerging markets.

Street Address:

600 Madison Avenue, 10th Floor

City:

New York

State/Province:

NY

Country:

USA

Where Else Does 17 Asset Management Operate Around the World?

Paris, France

Address: Representative office, specific address not publicly listed (often co-located or uses flexible office space)

To expand 17 Asset Management's reach within the sophisticated European impact investing ecosystem, manage relationships with European partners, and originate investment opportunities particularly relevant to European and African markets.

Buying Intent Signals for 17 Asset Management

Highperformr Signals uncover buying intent and give you clear insights to target the right accounts at the right time — helping your sales, marketing, and GTM teams close more deals, faster.

Who's Leading 17 Asset Management? Meet the Executive Team

As of April 2025, 17 Asset Management' leadership includes:

Who's Investing in 17 Asset Management?

17 Asset Management has been backed by several prominent investors over the years, including:

What Leadership Changes Has 17 Asset Management Seen Recently?

Based on publicly available information, there have been no major executive hires or departures announced by 17 Asset Management in the last 12 months, suggesting stability in its core leadership team. Abigail Königes' appointment as COO was in late 2022/early 2023, which might be slightly outside the strict 12-month window depending on the current date.

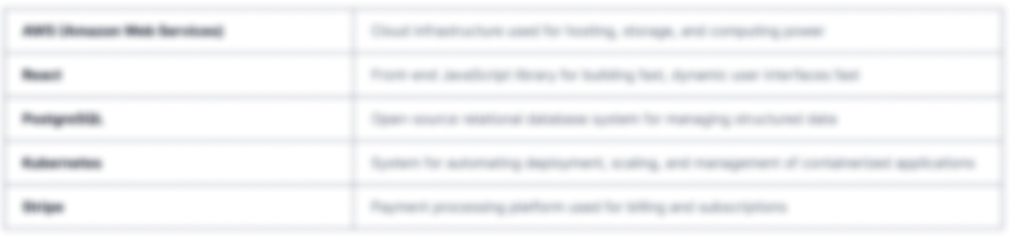

What Technology (Tech Stack) Is Used by17 Asset Management?

Discover the tools 17 Asset Management uses. Highperformr reveals the technologies powering your target accounts — helping your sales, marketing, and GTM teams prioritize smarter and close faster.

17 Asset Management Email Formats and Examples

17 Asset Management typically uses a standard corporate email format. The most common format appears to be the first initial followed by the last name.

[first_initial][last]@17assetmanagement.com

Format

jrivkin@17assetmanagement.com

Example

90%

Success rate

What's the Latest News About 17 Asset Management?

FinDev Canada • December 13, 2023

FinDev Canada and IDB Lab join forces with 17 Asset Management’s Blue Economy Fund for Latin America and the Caribbean

FinDev Canada and the Inter-American Development Bank (IDB) Lab announced their investment in the CRI Blue SMA Fund, LP, a blended finance fund managed by 17 Asset Management. The fund targets investments in the blue economy across Latin America and the Caribbean, aiming to promote sustainable use of ocean resources for economic growth, improved livelihoods, and ocean ecosystem health....more

17 Asset Management (LinkedIn) • May 26, 2023

17 Asset Management Co-Designs with UNICEF a Results-Based Blended Finance Solution for Education in West Africa

17 Asset Management, in collaboration with UNICEF, has designed a pioneering results-based blended finance instrument focused on improving education outcomes in West Africa. This initiative leverages innovative financing to drive progress towards SDG 4 (Quality Education) in the region....more

HIP Investor • February 2, 2023

HIP Investor and 17 Asset Management Partner to Launch SDG Alignment Ratings for Global Equities

HIP Investor and 17 Asset Management announced a partnership to introduce SDG Alignment Ratings for global equities. This collaboration aims to provide investors with transparent metrics to assess how publicly traded companies align with the UN Sustainable Development Goals....more

Highperformr's free tools for company research

Explore Employees by Region or Country

See where a company’s workforce is located, by country or region.

View Funding Details

View past and recent funding rounds with amounts and investors.

Understand Revenue Insights

Understand company revenue estimates and financial scale.

Track Active Job Openings

Track active roles and hiring trends to spot growth signals.

Review Product and Offerings

Discover what a company offers—products, platforms, and solutions.

Get SIC or NAICS Codes

Get the company’s official SIC and NAICS classifications.

Analyze Website Traffic Trends

Analyze visitor volume, engagement, and top traffic sources.

Discover Social Profiles and Engagement

Explore LinkedIn, Twitter, and other active social profiles.

Identify Top Competitors

Identify top competitors based on similar business traits.

Research and Discover Companies with Highperformr — Smarter, Faster

Explore companies in depth — from the tech they use to recent funding, hiring trends, and buyer signals — all in one powerful view.

Highperformr AI helps you surface the right accounts and enrich your CRM with verified company and contact insights, so your teams can prioritize and engage faster.

- Track intent signals to find buyers who are actively in-market

- Enrich contacts and companies instantly, no need to switch tools

- Automate workflows to stay ahead of every change

- Connect your CRM & tools for seamless data sync and activation

Thousands of companies, including 17 Asset Management, are just a search away.

.png)

.png)